Irrevocable Trusts

Memorandum to the Settlor and the Trustee

by Layne T. Rushforth

For printing, we recommend using the version in Adobe Acrobat (.pdf) format. For the .pdf version, click here.-

1. GENERALLY

This memorandum is for the settlor (creator) and the trustee (manager) of an irrevocable trust. There is a section for each of you, but we recommend that the Settlor and the Trustee read the entire memo. This is a general memo that does not address the provisions of any specific trust instrument; be sure to read the trust agreement carefully to determine if there are exceptions that may apply to a particular trust or situation.

-

1.1 Overview: An irrevocable trust that is designed to own assets for the designated beneficiaries on the terms and conditions that are set forth in the trust agreement.

-

(a) Estate Tax: An irrevocable trust is usually designed to avoid estate taxation on trust assets. Because of that, the settlor cannot retain the right to benefit from the trust. Aside from a limited right to change the trustee, the settlor should retain no power or control over trust assets.

-

(b) Grantor Trust? A trust can be designed so that the settlor is required to pay the tax on trust income. If it is designed that way, it is called a "grantor trust" for income tax purposes. If it is a grantor trust, the trustee might have the power to reimburse the trustee for the amount of tax paid by the settlor on trust income. If the trust is not a grantor trust, the tax on trust income is paid by the beneficiaries to the extent the income is distributed to them, and the trustee is responsible to pay the tax on undistributed income. Grantor trust issues are discussed further below.

-

-

1.2 Gift Giving and Purchases: The trust can obtain assets by way of gifts or purchases. The trustee is required to prudently invest assets and to account for all receipts and disbursements.

-

-

2. SETTLOR

Here are a few guidelines for the Settlor to keep in mind after signing an irrevocable trust:

-

2.1 Initial Contribution: After signing the trust, make the initial contribution of assets to the trustee. You must give up all of your rights to the trust assets. You may not retain direct or indirect control over trust assets. You should not give the trustee written instructions, especially regarding asset management or distributions to beneficiaries; however, written clarifications regarding your intent are acceptable.

-

2.2 Gifts by Others: Under most circumstances, anyone except a trustee, a beneficiary, or a potential beneficiary can contribute assets to the trust, but sometimes it is unwise to do so. If someone other than you, the Settlor, wants to contribute assets to the trust, let us know.

-

2.3 Trust Obligations: You should NEVER pay trust obligations (debts, insurance, taxes, etc.) for the trustee or allow such payments to be deducted from your personal account or from a business account. If the trust needs money to pay its obligations, you should make a gift to or documented loan to the trustee.

-

2.4 Periodic Contributions: You may periodically make contributions of cash or other assets to the trust, as you deem appropriate, but never tell the trustee what to do with those contributions. That is governed by the trust instrument.

-

(a) If you want to make a contribution to cover an obligation of the trust, make the contribution to the trustee, but do not make any notation on the check or give any written instruction that could be construed as a direction to the trustee. Remember, you cannot retain control over the trust assets. Even the appearance of control by you can create problems.

-

(b) For the same reasons, avoid making contributions on when obligations are due and in the exact amount of the obligations. If your intent is to see that payments on a loan secured by trust assets are made, it is better to make contributions in excess of the debt service or insurance premiums so that the trustee can keep an interest-bearing bank account open and even invest in other assets, as the trustee deems appropriate.

-

(c) A sale of an asset to the trust for it fair-market price is not a gift. If the purchase price is less than the fair-market value of the asset, the transaction is considered a part sale and part gift. For example, if the settlor sells land worth $100,000 to the trust for $60,000, there is a $60,000 sale and a gift of $40,000.

-

(d) Contributions to the trust without consideration are taxable gifts. So that contributions of $13,000 or less per beneficiary will not be taxed (1), the trust will usually provide that contributions may be withdrawn by the designated beneficiaries. Because of a court case involving a family with a surname of "Crummey", this right of withdrawal is sometimes referred to as a "Crummey power".

-

(1) In order to qualify for the annual gift tax exclusion, trust contributions must be subject to withdrawal by one or more beneficiaries. If the trust document does not make the contributions subject to a withdrawal right, you must give the trustee notice that you want a withdrawal right to apply.

-

(2) The trust agreement may give you the power to designate different beneficiaries who have the right to make the withdrawals for each contribution. A withdrawal right should not be given to a person who is not a bona fide beneficiary; the IRS may disallow the annual gift tax exclusion.

-

(3) In addition, the trust may allow you to specify that any contribution is not subject to this withdrawal right; however, if you do, a gift tax return (IRS Form 709) will be required for that contribution, and you will have to apply part of your lifetime gift and estate tax "applicable exclusion" of $5,000,000 (2) (or actually pay a gift tax of 35% (3) if you've already used up your "exclusion"). Although up to $13,000 can be withdrawn without immediate gift-tax consequences, there can be adverse tax consequences for your beneficiaries if "withdrawable" contributions exceed $5,000 per beneficiary, so we recommend that you contact us before making such contributions.

-

(4) Even if the beneficiaries have a withdrawal right, your contributions may exceed your available annual gift tax exemption requiring you to pay gift tax or use up your "applicable exclusion" that is available for gift and estate tax purposes. If the gifts to the trust exceed the beneficiaries' cumulative withdrawal rights, a federal gift tax return (IRS Form 709) must be filed at the same time you file your individual income tax return (IRS Form 1040) for the year in which the gift was made.

-

(5) We recommend that you consult us or your CPA before giving grandchildren or younger generations ("skip persons") a right to withdraw trust contributions. Whenever skip persons are beneficiaries or even potential beneficiaries, the federal generation-skipping transfer tax ("GST tax") is a concern. Each person has a "GST exemption" that exempts $5,000,000 (4), but that exemption needs to be allocated wisely.

-

(A) Under the Internal Revenue Code, some allocations of the GST exemption are automatic and others must be made affirmatively on a federal gift tax return (IRS Form 709). Certain contributions for your grandchildren or younger generations may automatically use up your GST exemption for purposes of the federal generation skipping tax, but if your GST exemption is better used elsewhere, you may want to elect out of the automatic allocation.

-

(B) On the other hand, you may wish to allow the automatic allocation for skip persons and to affirmatively elect to allocate GST Exemption to contributions being made to children if the trust permits GST-exempt shares to pass tax free to the next generation.

-

(C) It is better to use up the GST exemption (especially with respect to the gifts of "discounted" assets) than to expose the trust (including any appreciation or growth) to the generation-skipping tax (which is currently a 35% flat rate). (5) If you determine that GST Exemption should be allocated to any or all trust contributions for a calendar year, that GST Exemption allocation should be shown on a gift tax return (IRS Form 709), which is due April 15 of the following year.

-

(D) Even if the withdrawal right makes all trust contributions excluded for gift tax purposes, a federal gift tax return (IRS Form 709) may be required to allocate the GST exemption (or to cancel the automatic GST exemption allocation) to trust contributions so that the trust is either exempt or nonexempt in the proportions you decide for purposes of the federal generation skipping transfer tax ("GST tax"). If this is not done right, the problem may not be discovered until it's too late to correct.

-

-

(6) In addition, the trust agreement may allow you to specify that any contribution is not subject to this withdrawal right; however, if you do, a gift tax return (IRS Form 709) will be required for that contribution, and you will have to use part of your lifetime gift and estate tax "applicable exclusion" of $5,000,000 (6) (or actually pay a gift tax you've already used up your "applicable exclusion".)

-

-

-

2.5 Generation Skipping: Some trusts, known as "generation-skipping trusts", are designed so that two or more generations benefit from the trust without triggering the estate tax or the GST tax. A trust that is designed to last as long as the law will allow is referred to as a "dynasty trust". (7) If an irrevocable trust is designed as a generation-skipping trust, it is imperative that the donor's GST exemption be allocated for each contribution to the trust. This is done by filing a federal gift tax return (IRS Form 709). We recommend against relying on the automatic allocation rules that apply to the GST exemption. Failure to properly allocate the GST exemption will, at best, cause the trust to fail as a generation-skipping trust, or, at worst, will trigger the GST tax when the trust passes to grandchildren or other "skip persons" (i.e., beneficiaries who are in the grandchildren's generation or lower).

-

2.6 Special Rules If Spouse is Beneficiary: If you have created a trust which provides benefits to your spouse after your death, all contributions to the trust must be made from your separate property.

-

(a) If contributions of community property funds are made to an irrevocable trust and the Settlor's spouse is a beneficiary, the assets (or at least some of the assets) will be included in the spouse's estate for federal estate tax purposes.

-

(b) If you do not have separate property funds to contribute to the trust, then community funds must be converted into separate funds. For example, if you have decided to contribute $20,000 to the irrevocable trust, you must take $10,000 of community funds and give $10,000 to your spouse, to be placed in a separate property account, and the remaining $10,000 can be contributed to your irrevocable trust.

-

-

2.7 Insurance Policies: A life insurance trust is an irrevocable trust that is designed to own life insurance on the life of the Settlor. Life insurance is commonly held in irrevocable trusts, but owning life insurance and income-producing assets in the same trust can present extra complexities, especially with respect to income taxation. It usually simpler to have a separate trust for life insurance, and it is important to weigh the tax consequences before mixing insurance with other assets.

-

(a) It is intended that life insurance proceeds payable to an irrevocable trust will be free from federal income taxation and federal estate taxation upon the Settlor's death, and it is possible that an insurance trust could pass several generations free from the federal generation-skipping transfer tax as well.

-

(b) Whether or not the intended benefits are obtained depends primarily on following very strict guidelines with respect to the transfer of insurance to the trust, the making of gifts to the trust, the payment of insurance premiums by the trustees, and the trustee's compliance with all trust provisions.

-

(c) If the Settlor dies within three years of owning any incident of ownership in a life insurance policy, the entire proceeds are taxable for federal estate tax purposes.

-

(d) If you transfer an existing policy, you must not retain any incident of ownership in the policy, including any right to change the beneficiary, borrow against cash value, or otherwise participate in any decision affecting the policy or its benefits.

-

(e) A policy should never be sold to the trust by anyone except an insurance company, the insured, or a grantor trust of the insured (under proper circumstances). You, as the insured, can purchase an existing policy from another owner and contribute it as a gift, but the proceeds from any insurance policy transferred from you within three years of death will be taxed in your estate under federal estate tax laws. It is better if the initial contribution is made in cash, giving the trustee the discretion to find the best insurance policy and/or other investments for the trust and avoiding the 3-year-of-death rule for existing life insurance policies.

-

(f) You should NEVER make the premium payments for the trustee, allow premiums to be deducted from your personal account, or pay premiums from a business account.

-

-

2.8 Grantor Trust: Many irrevocable trusts are designed as "grantor trusts" for income tax purposes. This means that any income received by the Trustee during the Settlor's lifetime will need to be reported on the Settlor's individual income tax return (IRS Form 1040), regardless of whether the Trustee retains the income in the Trust or distributes it to one or more beneficiaries. Because of this, we recommend that the Settlor consult us or the Settlor's CPA before transferring any significant funds or other assets to the Trust.

-

(a) A grantor trust can purchase life insurance from the grantor or another grantor trust without triggering income tax under the "transfer-for-value" rules that are part of the federal income tax laws.

-

(b) If done correctly, a grantor trust can purchase appreciating assets from the grantor without triggering capital gain.

-

(c) A beneficiary's right of withdrawal ("Crummey power") can adversely affect the grantor trust status of the trust, so it is important to review the importance of the grantor trust status before making a contribution that is subject to a withdrawal right.

-

(d) If the grantor trust status of the trust becomes undesirable, in most irrevocable trusts it can be changed.

-

-

-

3. TRUSTEE

The trustee of an irrevocable trust should follow these instructions:

-

3.1 Acting as Trustee: All transactions you make in behalf of the trust should clearly reflect that you are acting as trustee.

-

3.2 Tax Identification Number: We recommend that you immediately apply for a "tax identification number" or "TIN" (also referred to as an "employer identification number" or "EIN") for the trust, even if the trust is a "grantor trust" for federal income tax purposes. This is done using IRS Form SS-4 or it can be applied for online on the IRS web site (8). The Trustee should never use his or her own social security number (or, for a business entity, its EIN) for a trust bank account.

-

3.3 Bank Accounts: All cash contributions should be deposited into a separate account established solely for the trust. The bank (or other financial institution) should be given the trust's tax identification number when the account is opened.

-

3.4 Personal Account: Never deposit trust contributions into a personal account or make payments in behalf of the trust from a personal account.

-

3.5 "Withdrawable" Contributions: The primary beneficiaries of the trust will usually be given at least 30 days to withdraw their pro rata shares of contributions to the trust (up to $13,000 each).

-

(a) This withdrawal right is outlined in the trust document, and you should follow the instructions carefully. If contributions are subject to a withdrawal right, you must maintain liquid funds to be able to satisfy those rights until the withdrawal right lapses.

-

(b) You should comply with the trust provisions relating to giving notice to the trust's beneficiaries of their withdrawal rights. The IRS' position is that unless a beneficiary has actual knowledge of the right of withdrawal, the gift cannot qualify for the gift-tax annual exclusion, resulting in the use of Unified Credit (or the payment of gift taxes if the Unified Credit has already been used). If, under the terms of the trust agreement, the withdrawal right becomes effective when the notice of the withdrawal right is given, it is imperative that the notice be given concurrently with the contribution, not later.

-

(c) It is imperative that you comply with the requirements of the Trust regarding the sending of notice. Because the IRS does not recognize notice waivers, the notice of a beneficiary's right of withdrawal should be sent even if a beneficiary signs a waiver indicating that he or she waives the right to receive future notices! Under some situations, a portion of trust contributions withdrawable by grandchildren or younger generations must be set aside as separate trusts, particularly if the settlor does not elect to allocate some of the GST exemption to such contributions.

-

-

3.6 Records: Keep meticulous records relating to the trust's assets, income, and expenditures. You must file a fiduciary income tax return (IRS Form 1041) unless the income from the trust assets is below the minimum amount indicated on the return. If the trust is a "grantor trust" for federal income tax purposes, the IRS Form 1041 merely needs to declare that the trust is a grantor trust for federal income tax purposes and that all income received by the trust is being reported on the individual tax return (IRS Form 1040) of the trust's settlors (whose names and social security numbers should be provided). (9)

-

3.7 Independence: You must act independently. If the IRS perceives that you are merely an agent for the Settlor, the trust assets may be included in the Settlor's estate for federal estate tax purposes.

-

3.8 Sales; Loans: If cash is needed by the Settlor, the Settlor's estate, or the trustee of any other trust created by the Settlor, you may purchase assets belonging to any such entity. You may also make loans. The terms of any sale or loan should be those that are commercially acceptable at that time between unrelated persons.

-

3.9 Investments: Under current law, life insurance can often be the best way to provide for tax-free funds; however, you are not restricted to life insurance investments. You may purchase any investment permitted under the terms of the trust agreement.

-

3.10 Taxes; Liabilities: This trust is written so that its assets will NOT be considered part of the Settlor's estate for federal estate tax purposes. You should never pay any tax or other liability owed by the Settlor, the Settlor's estate, or the trustee of any other trust created by the Settlor.

-

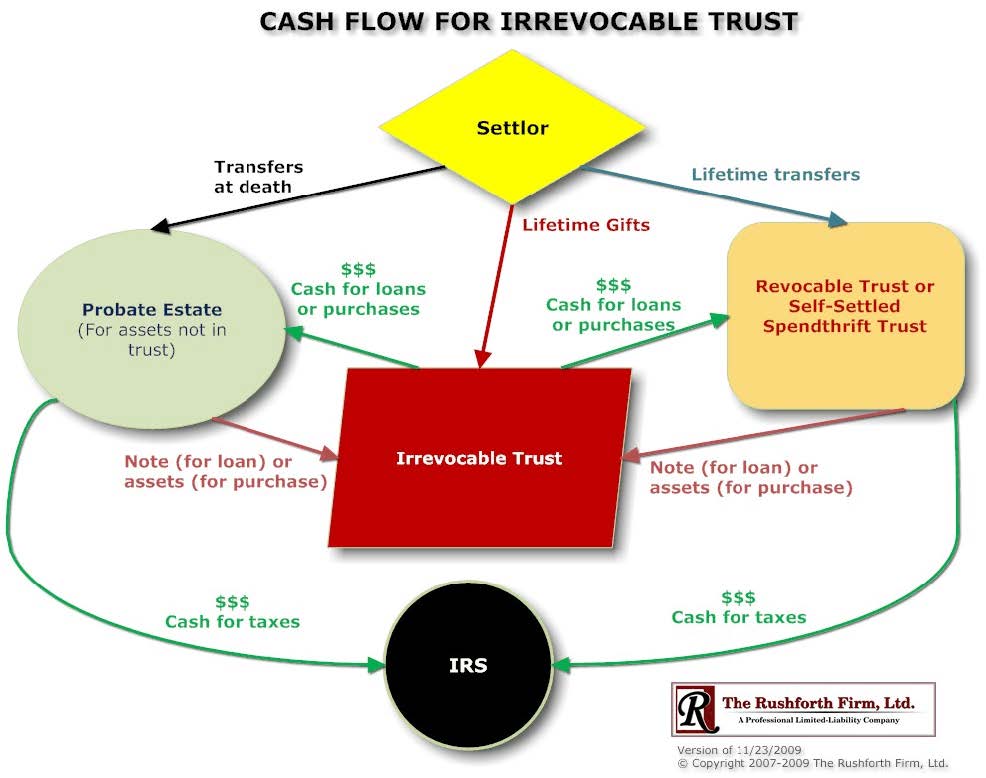

3.11 Coordination with Other Trusts: Although the irrevocable trust is excluded from the Settlor's estate, its assets can be available to help pay taxes and other expenses, if proper arrangements are made. In order to avoid estate taxation, the irrevocable trust cannot be required to pay any taxes or other expenses allocable to the Settlor's probate estate or to the Settlor's revocable trust. As mentioned above, the trust instrument specifically allows its trustee to engage in fair-market transactions with those other entities, allowing the insurance trust to purchase illiquid assets and giving the probate estate and/or revocable trust the liquid funds it needs.

-

(a) During the Settlor's lifetime, the Settlor makes gifts to the Trustee, and the Trustee makes trust investments, which may include the payment of premiums on life insurance policies on the Settlor's life.

-

(b) Upon the Settlor's death, the Trustee collects all trust assets, including any insurance policy proceeds. If there is insurance, the cash from the insurance can be used to purchase illiquid assets from the entities that are taxable (the probate estate and revocable trust). The irrevocable trust will usually wind up owning illiquid assets, but because there are no taxes to pay, there is no rush to liquidate assets at "fire sale" prices.

-

-

3.12 Other Advisors: The trust instrument may designate other persons who may have some authority to influence the trustee's role. For example, a "trust protector" may have the right to add a co-trustee or to modify the rights of a beneficiary, an "investment advisor" may have the right to recommend or to direct how trust assets are invested, and a "loan director" may have the right to compel you to make loans on favorable terms to specified persons.

-

(a) You must carefully follow the terms of the trust. If the trust document says that you "may" take an action, it means you have the authority but not the requirement of taking that action. In contrast, if the document says that you "must" or "shall" take an action, you are required to take that action, even if you do not think it is prudent or advisable.

-

(b) If you have questions about what the trust agreement requires or does not require, you should consult an attorney experienced in trust and estate matters and who does not have a conflict of interest in the matter. For example, if our firm represents the settlor of the trust, and the settlor is requesting that you take some action that would favor the settlor, our firm could not advise you on the matter because a conflict-of-interest would exist.

-

-

| NOTE: This memo provides general information only and does not contain legal, accounting, or tax advice. For brevity, this memo is oversimplified and should not be relied on for any particular situation. Although this memo may discuss tax issues, this is not a "covered opinion" as defined in Circular 230 issued by the U. S. Treasury Department, and nothing in this memo can be relied upon to avoid any tax penalties. |

1. During each calendar year, each taxpayer can exclude certain gifts from the gift tax. There is a $13,000 "annual exclusion" applicable to gifts made to each donee (recipient) during each calendar year. This amount is subject to cost of living increases. Other exclusions that have no dollar limitation include: (1) tuition you pay directly to the educational institution for someone else; (2) medical expenses you pay directly to the health-care institution for someone else; (3) gifts to your spouse; and (4) gifts to a political organization for its use. The "applicable exclusion" that is available for taxable transfers during life and at death will not be affected except as to gifts that exceed these exclusions. Gifts that exceed the annual exclusions and the lifetime "applicable exclusion" will trigger a gift tax.

2. Internal Revenue Code § 2010(c) provides for an "applicable exclusion", which is the cumulative amount that can pass free of gift and/or estate tax. For ESTATE TAX purposes, the applicable exclusion has been, is and will be: $600,000 in 1997, $625,000 in 1998; $650,000 in 1999; $675,000 in 2000 and 2001; $1,000,000 in 2002 and 2003; $1,500,000 in 2004 and 2005; $2,000,000 in 2006, 2007, and 2008, $3,500,000 in 2009; unlimited in 2010; $5,000,000 in 2011; $5,120,000 in 2012; and $1,000,000 in 2013 and beyond. The applicable exclusion for GIFT TAX purposes is the same as that for estate tax purposes from 1997 to 2004 and for 2011 and 2012. For 2005 through 2010 and for 2013 and beyond, the applicable exclusion for GIFT TAX purposes is fixed at $1,000,000.

3. The maximum rate imposed for federal estate tax purposes was 55% from 1997 to 2001. It was 50% in 2002; 49% in 2003; 48% in 2004; 47% in 2005; 46% in 2006; 45% in 2007, 2008, and 2009; 0% in 2010; 35% in 2011 and 2012; and 55% in 2013 and beyond.

4. The federal generation-skipping transfer tax ("GST tax") is imposed at the highest rate imposed for federal estate tax purposes, which is shown in note 3, 5. For 2011 and 2012, the GST exemption is the same as the applicable exclusion for estate tax, as shown in note 2. For 2013 and beyond, the GST exemption will be $1,000,000 plus cost of living adjustments since 1997.

5. The maximum rate imposed for federal estate tax purposes was 55% from 1997 to 2001. It was 50% in 2002; 49% in 2003; 48% in 2004; 47% in 2005; 46% in 2006; 45% in 2007, 2008, and 2009; 0% in 2010; 35% in 2011 and 2012; and 55% in 2013 and beyond.

6. See note 2.

7. Nevada has a "Rule against Perpectuities" that requires a trust to terminate 21 years after the death of the last potential beneficiary who was living when the trust was established (or 90 years, if longer) unless the trust specifies a longer term, which can be as long as 365 years.

8. http://r4lv.com/IRS-EIN

9. See Treasury Regulations §1.671-4(b) for more details.